Shooting Star Candlestick Pattern Beginner's Guide LiteFinance

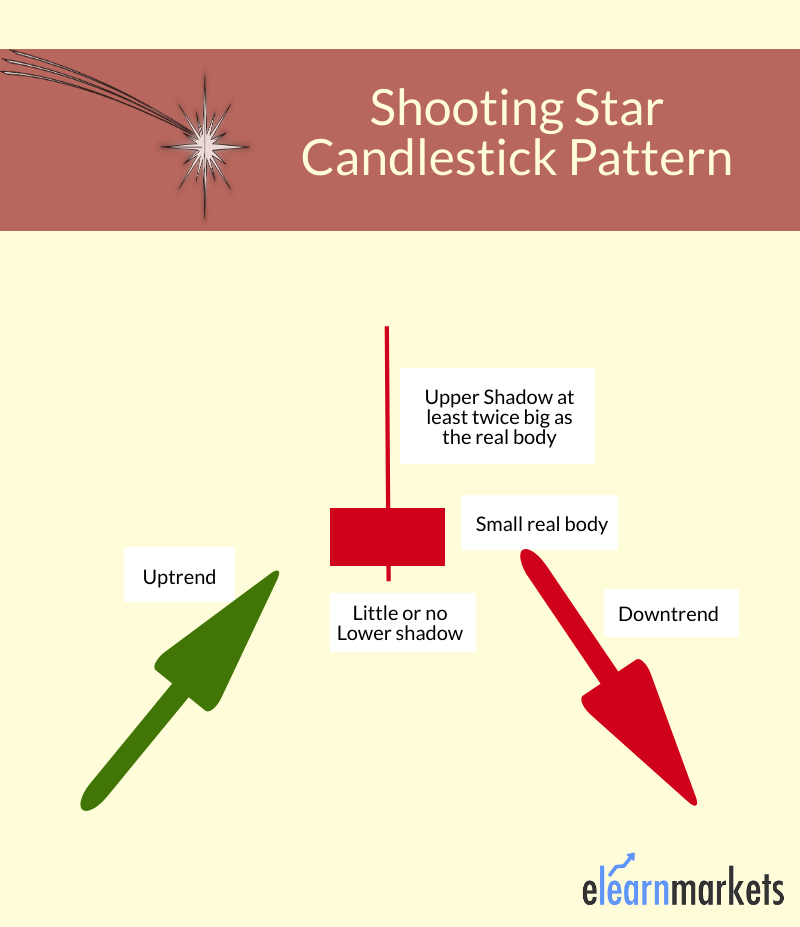

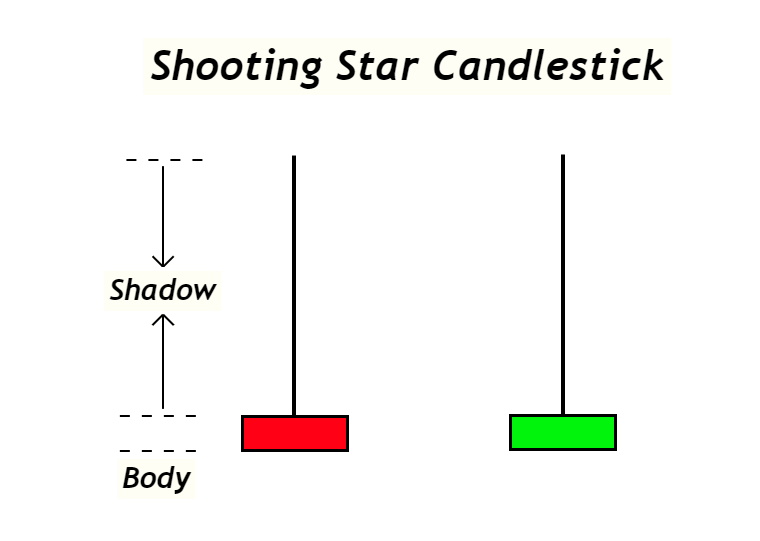

A shooting star candlestick pattern is a chart formation. It occurs when the price of an asset is significantly pushed up, but then rejected and closed near the open price. This makes a long upper wick, a small lower wick and a small body.

Powerful Shooting Star Candlestick Formation, Example & Limitations2022

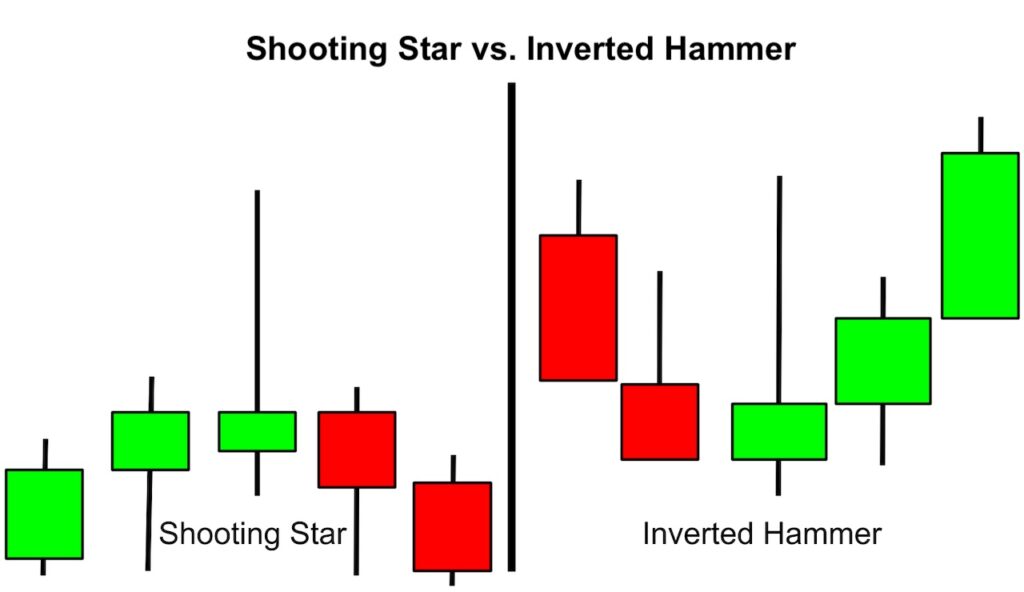

The inverted shooting star is a bullish analysis tool, looking to notice market divergence from a previously bearish trend to a bullish rally. An inverted shooting star pattern is more commonly known as an inverted hammer candlestick. It can be recognized from a long upper shadow and tight open, close, and low prices — just like the shooting.

How To Trade Blog What Is Shooting Star Candlestick? How To Use It Effectively In Trading

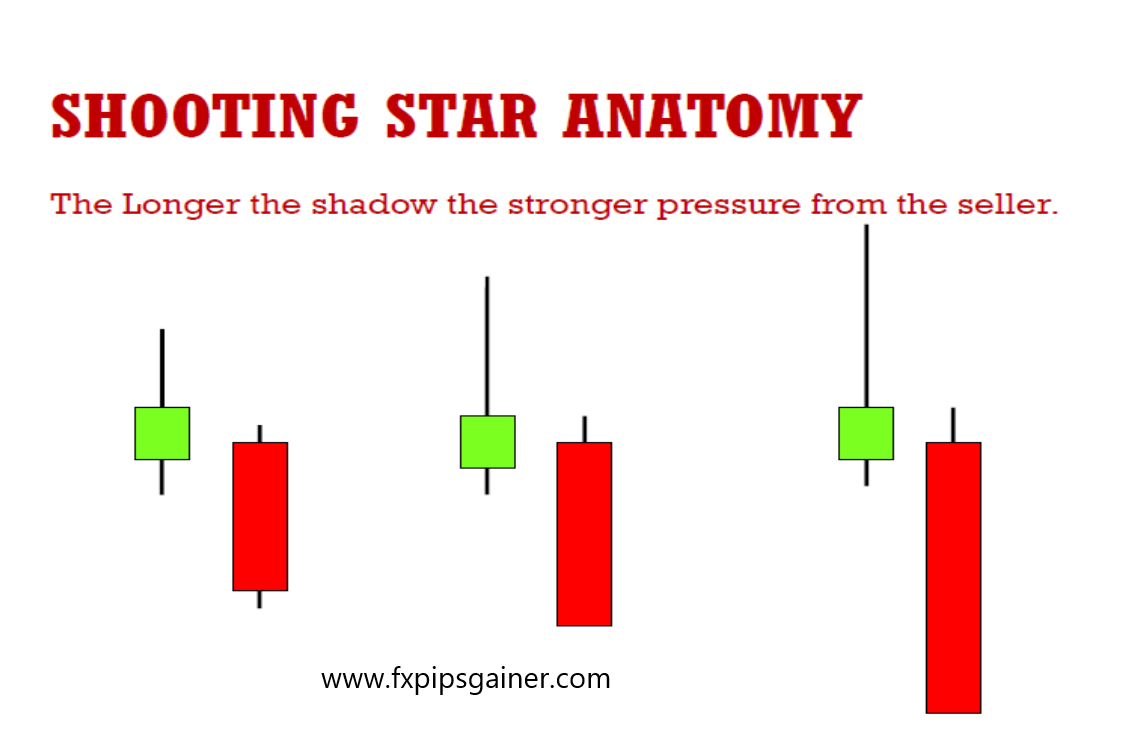

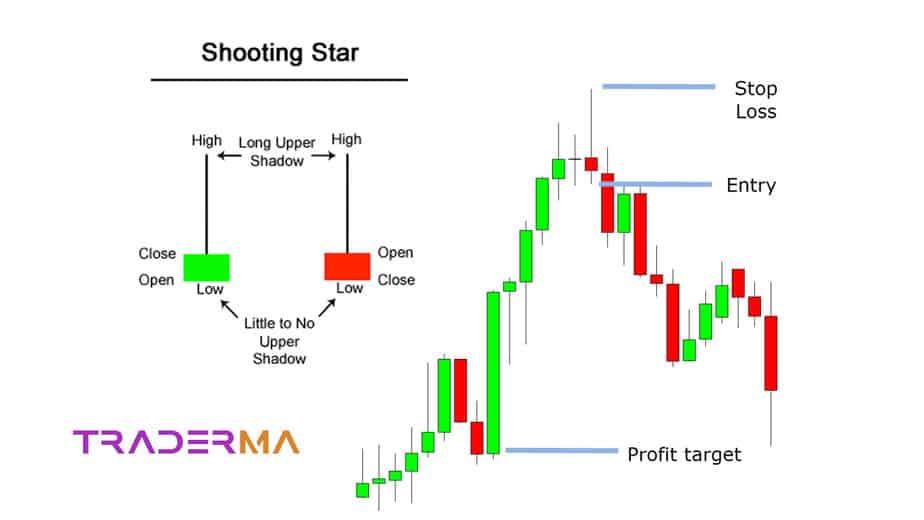

Variants of the Shooting Star Candlestick Pattern. The Shooting Star candlestick pattern may appear a little different on your charts. The color of the body doesn't matter, it can be either red or green (bearish or bullish). The existence or not of a wick (shadow) at the bottom doesn't matter too. As long as it's small you're good to go.

How to Trade the Shooting Star Candlestick Pattern IG Australia

A shooting star is a single-candle bearish pattern that generates a signal of an impending reversal. Similar to a hammer pattern, the shooting star has a long shadow that shoots higher, while the open, low, and close are near the bottom of the candle. It is considered to be one of the most useful candlestick patterns due to its effectiveness.

Learn How To Trade the Shooting Star Candle Pattern Forex Training Group

The Shooting Star candlestick pattern is a bearish reversal pattern that occurs at the top of an uptrend. It is a single candlestick pattern that is formed when the open, high, and close prices are all relatively close together, but the candle has a long upper shadow (wick) that is at least twice the size of the real body (the difference between the open and close prices).

How to Use Shooting Star Candlestick Pattern to Find Trend Reversals Bybit Learn

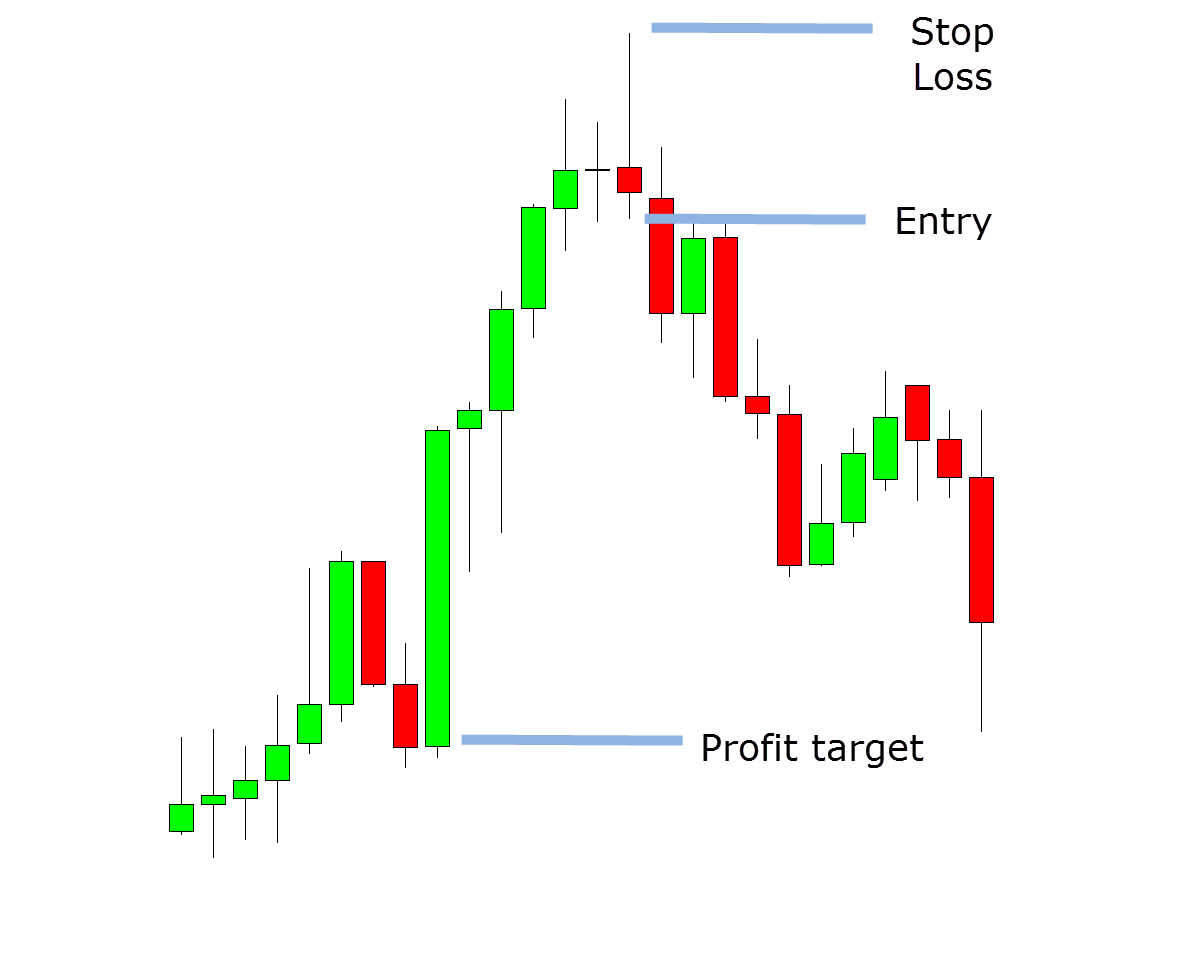

Raining Profits. The blue arrows on the image measure and apply three times the size of the shooting star candle pattern. After we short Apple, the price enters a downtrend. After the first bearish impulse on the chart, the price creates a range between $107.30 and $107.40 per share.

What Is Shooting Star Candlestick With Examples ELM

What is a Shooting Star Pattern? A shooting star pattern is a bearish candlestick that can be identified with a long upper shadow and little to almost no lower shadow (candle wick). It also has a small real body that closes close to the low of the session. The shooting star pattern only appears after an upward swing in the price action. This is.

How to Use Shooting Star Candlestick Pattern to Find Trend Reversals Bybit Learn

A Shooting Star is a single candlestick pattern that is found in an uptrend. The candlestick can mark a top (but is often retested). A Shooting Star is formed when price opens higher, trades much higher, then closes near its open. This bearish reversal candle looks like the Inverted Hammer except that it is bearish.

Shooting Star Candlestick Pattern Forex Trading

In technical analysis, a shooting star candlestick is a bearish reversal pattern that forms after an uptrend. The meaning of the shooting star candlestick pattern is that buying pressure is starting to dissipate and a potential trend reversal may be on the horizon. The shooting star is sometimes referred to as the " shooting star Japanese.

Shooting Star Candlestick Pattern How to Identify and Trade

The shooting star candlestick pattern is a bearish reversal pattern. When this pattern appears in an ongoing uptrend, it reverses the trend to a downtrend. It has a bigger upper wick, mostly twice its body size. It has no lower wick or sometimes has a smaller wick. This is just an inverted hammer candle called a shooting star.

Learn How To Trade the Shooting Star Candle Pattern Forex Training Group

The shooting star pattern in candlestick charting represents a nuanced interplay of market forces, illustrating the ongoing battle between supply and demand, and the transition from bullish optimism to bearish reality. Central to the shooting star pattern is its pronounced upper shadow, symbolizing a significant change in market sentiment.

Shooting Star Candlestick Pattern For Beginners Part 7 Traderma

The shooting star is a bearish reversal candlestick that appears after a significant price advance. Therefore, it appears at the top of an uptrend suggesting that the price has peaked and the upward momentum is waning. In contrast, the inverted hammer is a bullish reversal candlestick pattern that occurs at the bottom of a downtrend.

Shooting Star Candlestick Pattern Beginner's Guide LiteFinance

September 3, 2022 Zafari. The Shooting Star Candlestick Pattern is a single reversal candlestick that forms at the top of a trend. It suggests a future downtrend. In other words, a shooting star candlestick is a single bearish pattern. A shooting star has a long upper shadow/tail and a small body at the bottom of the candle, with or without a.

A Complete Guide to Shooting Star Candlestick Pattern ForexBee

The shooting star candlestick pattern appears at short-term tops in the market, and is a bearish signal. As its name suggests, the shooting star is a small real body at the lower end of the price range with a long upper shadow.View Example

Shooting Star Candlestick Pattern Trading the Shooting Star Candlestick Pattern (Pinbar

A shooting star is a single-candlestick pattern that forms after an uptrend. It's a reversal pattern and is believed to signal an imminent bearish trend reversal. As to the pattern itself, a shooting star has a small body that's located in the bottom half of the candle's range, and has a long upper wick, with a low or absent lower wick..

Shooting Star Candlestick Pattern How to Identify and Trade

A shooting star candlestick is a technical analysis indicator. It is a Japanese candlestick pattern indicating a potential price trend reversal. It appears at the end of a bullish price trend. This candlestick pattern is characterized by its long upper shadow and a short lower shadow, with the candle body closer to the lower point.